Delivered by Wealth.com

Be sure to use an email that we have on file, as that is how our system will determine whether or not you are a client before granting you instant access. If you want to use a different email, don't worry, there will just be a time delay until we manually approve your access.

As always, we're here for you.

Just e-mail [email protected]

Essential Estate Plan Documents

Last Will & Testament

Revocable Trust

Advanced Health Care Directive

Financial Power of Attorney

Want to talk this through with us? Schedule a time where we can join you as you create your Estate Planning Documents.

We're here for you.

Just e-mail [email protected]

F.A.Q.

What is a Trust?

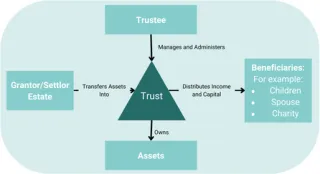

A Trust is a legal entity that holds assets in it. It is created by a Grantor or Settlor who puts assets into the Trust. The Trust's assets are managed and distributed by a Trustee.

The Trusts assets are distributed to the Beneficiary(ies) by the Trustee based on the Trust documentation.

What Characteristics Should My Executor, Trustee, and Guardian Have?

Your Executor should be Trustworthy, Ethical, Fair-Minded, have good Organizational Skills, and be Efficient. You want them to be able to settle your estate according to your will in a way that everyone feels is fair and according to your desired wishes.

Your Trustee should have similar traits to your executor, but this may be a longer role, so Reliability and Time may play a more important role here. They will also be making more financial decisions so Financial Competence is critical.

Your Guardian should share similar Values to you, be of an Age and Health that they can handle minor children, be Willing to accept the task, and, if your children are at an age where moving may be a challenge, Location or willingness to move is a significant factor. In addition, Financial Stability is a factor as well.

Can I have the same person/people in multiple roles?

While you can have someone serve in multiple roles, there are many reasons why you may choose not to.

If you can not find someone with the characteristics needed for every role, it may be easier to find multiple people to find specific roles.

Separating your Trustee from your Guardian for your children can help ensure that the assets you leave for your children are spent according to your wishes by creating a check and balance system.

In addition, if you want both sides of your children’s family remain involved in their lives, separating those roles can help ensure that.

How/When Should the Trust(s) for My Descendant(s) Distribute its Assets?

While you could structure your descendant's trust in a wide-variety of ways, there are limited options within Wealth's platform and we think that's okay for almost everyone.

The most common standard given to trust distributions is the HEMS standard - which stands for Health, Education, Maintenance, and Support. These are distributions that cover a wide variety of needs that IRS deems "ascertainable." Included in this could be expenses for things like medical treatment and therapy (Health), tuition or study-abroad expenses (Education), and living expenses, rent, mortgage, down payment on a home, or vehicles (Maintenance and Support). Wealth uses the HEMS language for distributions from descendent trusts.

Beyond that, your distribution timeline may depend some on the maturity and financial responsibility of your beneficiary(ies). Wealth's descendant trusts will distribute all assets when the beneficiary reaches the age of 30 and can accommodate one earlier partial distribution of the trust.

If you want to be more specific (e.g. allow distributions for non-educational travel or wedding expenses) or change the timeline for the distributions from the trust, you'll need to work with an estate attorney directly to write that into your trust language.

What if I need more complex Estate Plans than what Wealth Can Accommodate?

While Wealth's platform will work for the majority of people who are planning their estate, there are situations that it will not be able to accommodate or people with complex or extensive assets that will require the services of estate attorneys to create specific plans.

Examples of this are people who have dependents with physical or mental disabilities or a chronic illness that may require a special needs trust. Or people with enough wealth that they are nearing the Estate Tax exemption and would like to create a Bypass Trust.

If you believe that you are in need of an estate attorney for your estate planning, please reach out to us and we can recommend one to you.